Productivity and profitability are the main pillars of success of insurance agency. The more your salespeople get done, the more happy customers you can onboard.

However, increasing sales productivity isn’t as easy as putting your product in front of more people. Research on nearly 400 salespeople found that the vast majority (71.4%) believe 50% of their prospects are “not a good fit.”

Salespeople in insurance agency themselves are also struggling with job demands. Only 24.3% of employees surveyed exceeded their sales quota last year, and many unhappy insurance agents spend three or fewer hours a day on sales activities.

So, with these challenges in mind, how do you boost sales productivity? Below are seven strategies you can try.

1. Automate email marketing

Email marketing has changed the insurance marketing game. Now, instead of trying to appeal to prospects through attention-grabbing ads, you can reach leads through their inbox.

Email marketing works extremely well. Eighteen percent of recipients open the average email, and 2.6% click a Call-To-Action inside it. Subsequently, email marketing’s Return on Investment (ROI) is $36 for every $1 invested.

However, your email marketing can’t handle itself. Someone needs to design emails, add your subscribers to the email, send it, and ensure it doesn’t end up in the “spam” folder. Then, someone needs to analyze the email’s success with data and clean the email list.

This is a lot of work. But thankfully, a human doesn’t have to do it all. With an email marketing tool handy, you can build your marketing emails with a template and schedule them at your convenience. Then, the system will distribute the email, keep it out of spam folders, collect data, and present it in an easy-to-understand dashboard.

PathwayPort’s Marketing Automation is tool than off loads repetitive and manual tasks and help insurance agency speed up and streamline its business operations. It can handle newsletters, trigger-based campaigns, cross-selling, up-selling, quote-based marketing, and other email-based insurance marketing campaigns.

Automating your insurance marketing is a killer productivity hack. You’ll free up salespeople to attend to other tasks and nurture more leads with less effort.

2. Get real-time data dashboards for motivation

Gut feelings are great for many things. In life, they help you identify threats and bad situations, and in sales, they help you notice when a customer just needs one final push to close the sale.

Preparing these numbers manually would be very time-consuming (which you don’t need if you are looking to increase sales productivity)!

That’s where automated dashboards come in. PathwayPort’s feature-rich dashboard can help insurance agency make the right and timely decisions based on real-time data Instead. It will highlight areas of weakness and motivate your sales team to keep pushing.

Insurance agency can find a comprehensive report on:

- Revenue

- Number of new sales

- Number of sales for a specific plan

- Average revenue per customer

- Percentage of revenue from new vs. existing customers

- Number of sales made with a discount or deal

- Win rate

- Quota attainment

Now, to set up a dashboard, you need a program that tracks all sales.

3. Use a CRM

A Customer Relationship Management system or “CRM” is a tool that handles all your interactions with leads and customers.

CRMs have many benefits outside of just data analysis and reporting. They allow you to segment customers and leads into groups, create detailed sales reports, forecast future sales, score leads on their likelihood of turning into customers, and store data in a central location.

CRMs are game changers that revolutionizes insurance agency sales and productivity. Instead of flicking through spreadsheets or (even worse) a notebook, for example, salespeople can select a lead, see their details, and plan a sales strategy in seconds.

If your insurance agency holds sales calls over the phone (a medium 41.2% of salespeople believe is the most effective), CRMs have extra benefits. They can automatically record data like the length of calls and their date and time so you don’t need to collect this data manually.

CRMs are ultimate insurance agency’s tool because they streamline all the tasks employees need for sales calls and visits. Hence, using them will free up time for your salespeople to focus on the tasks that matter and brig even more productivity.

4. Remove paperwork from your on-boarding processes

When we picture a salesperson at work, we tend to think of a person confidently connecting with a prospective lead until they excitedly say “yes.” But that’s not the reality of insurance sales.

Insurance salespeople often need to handle dozens of paper-based tasks to close a sale. This might include collecting forms from clients, reviewing the information, entering it into the system, and transferring data between departments.

While this process is vital for the customer and insurance agency, the use of paper makes it slower than it needs to be. Imagine you could combine all steps into one! With PathwayPort is possible and cost-effective!

Tools like PathwayPort’s Forms let your leads complete all their forms digitally from their computer or mobile phone. This information is then distributed to you digitally so you don’t need to worry about data entry and the errors that arise from it.

Salespeople don’t even need to be involved in this process if leads don’t need them. They can move on to other sales activities and get more done in less time.

5. Prioritize staff learning

There’s a stark difference between top-performing salespeople and regular salespeople.

Fifty-one percent of top performers describe themselves as an “expert in their field,” compared to 37% of non-top-performers. Top-performing salespeople also have more experience, spend more time on sales-related activities, and spend less time on pitching.

One of the best ways to ensure your salespeople can develop the sales and time management skills top performers have is to provide them with ongoing education. You don’t need to carve out time daily or assign academic essays, but you should provide resources on topics like:

- Sales techniques like SPIN selling, SNAP selling, the Challenger sales method, and solution selling (plus when to use each of these)

- Active listening

- Cross-cultural communication

- Customer segmentation and behavior

- Your company’s history

- Sales lead management

- Your plans and their features

Depending on your organization, you could offer guidebooks, videos, short and actionable blog posts, brochures, tickets for insurance sales conferences and events, and presentations from guest speakers.

Helping your salespeople grow professionally will help them work smarter and, thus, more productively.

PathwayPort can help your employees be on the top of the insurance trends and learn everything they need to boost the sales, and be productive. Join our PathwayPort Insurance Academy.

6. Reduce insurance agency administration tasks with automation

We’ve already touched on a handful of time-consuming administration tasks insurance agents need to focus on, but these aren’t the only tasks on their plate. In many organizations, salespeople need to file paperwork, distribute forms internally, deliver policy documents, and arrange proof of insurance documents for customers.

Insurance agency automation tools like PathwayPort’s Business Process Automation can do all of these for you, plus missed payment reminders and plan renewals.

PathwayPort’s Business Process Automation can save your insurance agency a lot of time. Before using it, Advocate Insurance’s Technical Sales Representatives (TSRs) spent six to eight hours daily on plan renewals. Now, they spend two to three. You could reduce your salespeople’s workloads similarly.

7. Focus on SQLs (not MQLs)

In the introduction, we mentioned that about half of the prospects salespeople speak with aren’t customer material. Instead, some of them are likely Marketing Qualified Leads (MQLs) who are interested on paper but need more nurturing. Traditionally, salespeople have nurtured these leads. But there are other ways.

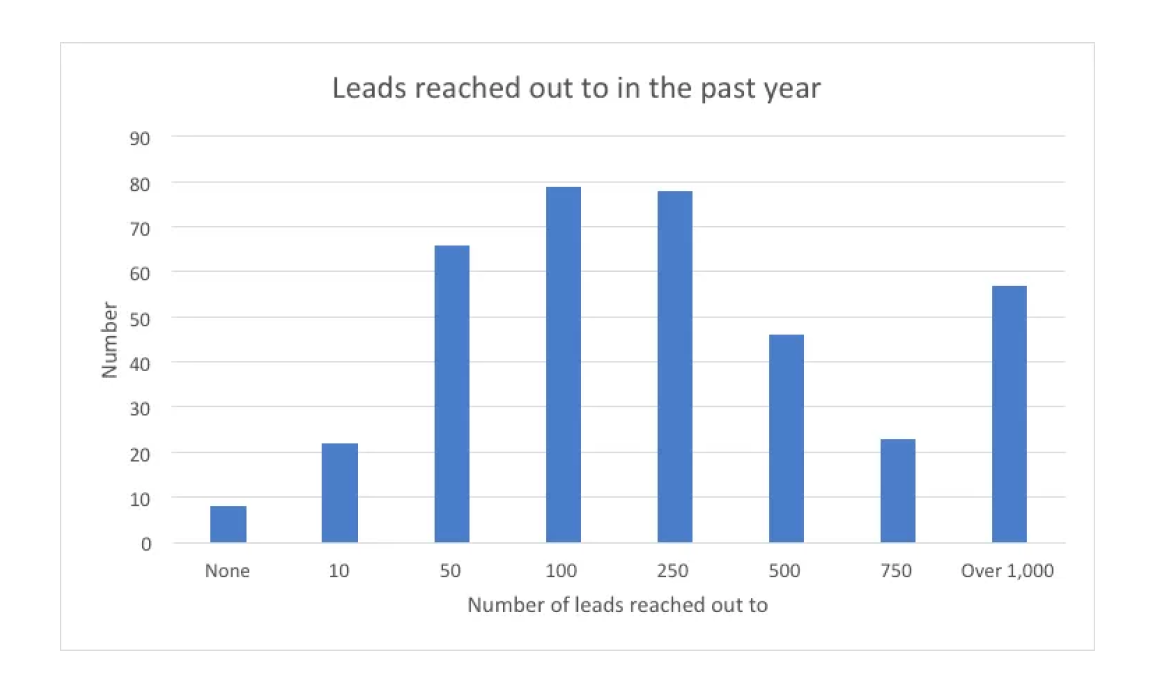

Salespeople only have limited time, as research shows the majority speak to less than 750 leads annually.

Source: SalesInsightsLabs

So, salespeople should focus their efforts on those that are the most likely to convert — Sales Qualified Leads (SQLs). These prospects have the desire, intention, and ability (financially and logistically) to close the deal.

There’s no perfect way to identify SQLs, but you can look for prospects who:

- Understand their insurance needs

- Are aware of their insurance options

- Display urgency to complete the purchase

- Respond positively to marketing

- Have the ability to complete the purchase

While salespeople focus on qualified leads, your organization can use insurance agency automation to nurture leads through email marketing, social media marketing, mail marketing, and quote-based marketing. Not only is this a more productive allocation of time, but it’s cheaper for your business long-term. Also, with PathwayPort automation solution you can easily identify SQLs from MQLs.

Work smarter with PathwayPort’s insurance automation tools!

Increasing your sales productivity isn’t as simple as asking salespeople to work harder and showing them a pretty motivational poster. Your salespeople already want to do a good job. They just need the strategies to help them do it.

To increase sales productivity, automate insurance tasks, use a CRM, prioritize learning, switch your focus to SQLs, and embrace digitization. And, of course, try PathwayPort’s marketing tools.

PathwayPort’s work-friendly tools are suitable for small businesses, multinational corporations, insurance marketing groups, and more. PathwayPort offers:

- Marketing Automation which can manage your email marketing, streamline your renewal process, billing and much more;

- Business Process Automation (BPA) which takes repetitive tasks off your plate;

- Self-Service Kiosk which lets customers serve themselves;

- Forms to help you create digital forms.’

Leave a Comment