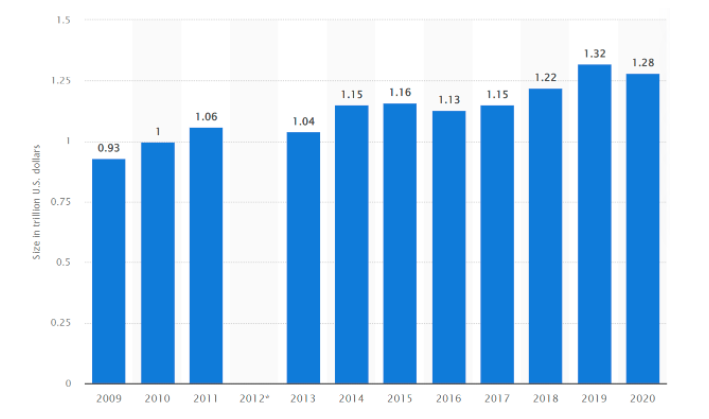

Insurance is one of the most competitive industries in the world. As of 2020, over $1 trillion worth of premium was written in the U.S. insurance market.

Source: Statista

Insurance agents and brokerage firms are under constant pressure to acquire and retain customers while reducing customer acquisition costs. One of the easiest ways to do this is through insurance automation.

The good news is that there are marketing technologies available today that can help industry stakeholders automate their insurance processes, from lead generation to claims management and customer service.

Below are six areas of insurance marketing that can be automated by insurance agents and brokerage firms today.

- Process Workflows

- Social Media Marketing

- Email Marketing Campaigns

- Lead Generation and Nurturing

- Reputation Management

- Re-marketing and Marketing Analytics

Process Workflows

Insurance companies have come a long way in automating their processes. But there are still many areas that need automation to reduce human errors and improve efficiency.

Insurance automation can help insurance agencies and insurers of all sizes automate their manual processes, increase the accuracy of their data, and expand their relationships with customers.

Automating your renewals, welcoming and onboarding new clients, and eliminating the risk of human errors are just a few examples of what you can do with insurance agency automation solutions.

With insurance automation of process workflows, you can:

- Save time by eliminating manual entry of client data

- Reduce errors during data entry

- Eliminate double-handling of customer data by taking advantage of an integrated system

- Generate accurate quotes and policy documents quickly

- Store all your customer information on a central database that’s accessible by everyone in the company

- Automatically generate renewal notifications for clients when their policies are due for renewal.

Social Media Marketing

In an age of high competition and complex customer journeys, insurance marketing automation has become a necessity. Marketing automation is not just about automating your marketing tasks but also about engaging the right audience at the right time.

Marketing automation is the process of using software to automate repetitive marketing tasks like social media posts, email campaigns, and web analytics. This technology aims to help businesses save time and money by eliminating manual work.

It allows you to focus on more critical areas like policy sales and operations by automating areas such as:

- Publishing content for social media posts.

- Scheduling social media campaigns ahead of time.

- Reaching out to new customers via targeted ads on Facebook or other channels like Google AdWords.

Email Marketing Campaigns

Email marketing is a great way to generate new leads and stay in touch with existing customers. But if every member of your team is sending out emails on their own, it can be hard to keep track of who’s in charge of what and how often emails are being sent.

One solution to this problem is to automate your insurance company’s email marketing campaigns.

With email automation software, you can:

- Create targeted email campaigns for prospective policyholders by segmenting lists based on their location, age, gender, income level, and other factors

- Create email templates for recurring campaigns such as newsletters or prospect letters.

- Inform your customer base about new insurance products, updated coverage terms or premium rate changes.

- Automate follow-ups with cold leads or prospects that have submitted forms on your website.

The best insurance marketing campaigns are about being customer-centric. Automation helps you get there.

Lead Generation and Nurturing

When we talk about lead generation, we mean the process of drawing potential customers’ attention to a company’s product or service and encouraging them to take some kind of action.

Since insurance is a high-consideration purchase, you’ll need to nurture your leads in order to earn their trust, so they’ll buy from you.

Insurance automation can help:

- Earn more leads through landing pages and forms that capture more information about your leads so you can build a relationship.

- Qualify your leads faster through automated emails and messages based on what your contacts do or don’t do on your website or landing pages.

- Nurture your leads until they’re ready to buy by creating an ongoing system for following up with each lead automatically until they’re ready to speak with an agent or purchase a policy from you.

Reputation Management

The insurance industry is subject to different types of consumer complaints and reviews, ranging from issues with policies and claims to general customer dissatisfaction with products or services.

These can all be effectively dealt with if you have an automated marketing system in place. Here’s how you can use insurance automation to stay on top of online reputation management:

- Chatbot integration to better assist customers in submitting their claims, getting policy details, and even buying new policies online.

- Set up workflows for review management that ensure every single review is responded to in a matter of minutes.

- Enable personalized auto-replies for incoming queries on email or social media platforms so prospects aren’t left hanging.

Re-marketing and Marketing Analytics

Whether it’s renewing policies with existing customers, or keeping on top of cold leads who haven’t purchased yet, there are always opportunities to bring your customers back into the funnel and convert them from prospects to policyholders.

One of the main challenges is simply keeping up with your sales cycle. Insurance agencies tend to be focused on servicing their clients’ needs rather than on optimizing their marketing processes. In fact, many insurance agents and brokers still rely heavily on manual processes like Excel spreadsheets and emails to manage all of their sales activities, from prospecting to policy renewal.

Insurance marketing automation enables businesses to:

- Better understand how prospects find you and learn about your offerings through surveys and website analytics.

- Re-engage with cold leads through remarketing ads that are only shown when they search for business insurance or visit a business insurance page on Google and Facebook respectively.

- Retain customers for repeat business by nurturing them and encouraging them for policy renewals or extended coverage.

Get automating with Pathway!

Marketing automation has changed the way insurance agencies offer their services to businesses and consumers.

With the rise of data-driven marketing and the Internet, more insurance companies are looking for ways to automate the marketing process.

Your insurance marketing decisions are made easier with Pathway, an integrated, all-in-one automated marketing solution for your business. You can:

- Streamline your workflows through our Office Bot

- Grow your email and social campaigns with our Marketing Bot

- Simplify form collection through our Form Builder

- Access your own dedicated self-service portal through our Kiosk

We understand that insurance agents have a lot on their plates. That’s why we’ve developed our system to make everything more efficient, so you can focus on growing your business.

Sign up with us today!

Leave a Comment

Comments:

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Comment by gralion torile on April 22, 2022 at 18:51Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a bit, but instead of that, this is fantastic blog. A great read. I’ll definitely be back.

Comment by Kristina Crowner on May 17, 2022 at 06:38