The idea of using a robot of any sort instantly spooks many business owners who assume they will lose the air of personalization and human touch that their business normally has. Robots conjure up images of impersonal machines that don’t understand human emotion, let alone have the ability to be empathetic.

When it comes to insurance, an industry that people need during worst-case scenarios, most businesses’ first thought is that they don’t want to use robots or seem like they can’t provide personalized attention. However, the fact that robots can’t help much is a huge misconception.

When properly implemented and in the right use cases, insurance automation bots can make such a massive difference to your business that refusing to use them is basically forcing yourself to fight with one hand tied behind your back.

So whether you think you might be in one of those situations where an insurance automation bot could help you perform better or you’re just curious about the use cases or situations that can benefit from assistance from an insurance marketing bot, then read on because, by the end of this article, chances are you’ll be kicking yourself for not implementing a bot sooner.

What is a marketing bot?

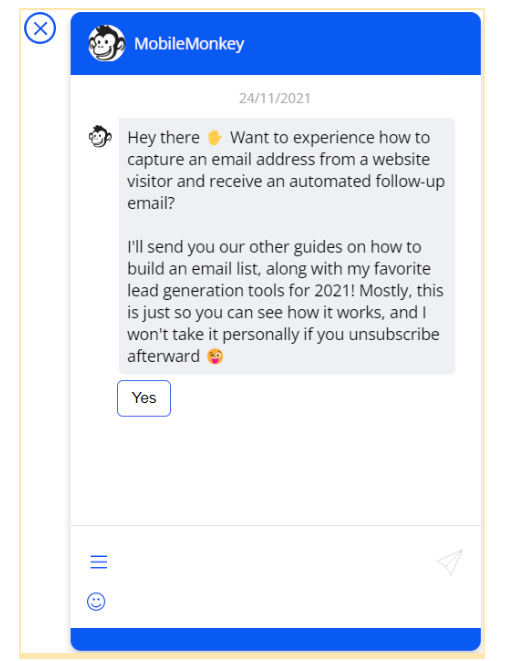

Image: Mobile Monkey using a marketing bot

A bot is essentially a software application that enables you to run automated marketing tasks. Bots are usually used to accomplish all kinds of automated, repetitive tasks not necessarily related to just marketing. What makes them special is that they can be programmed to carry out these tasks automatically and on their own.

Bots can be programmed to respond to received messages, respond with the same information each time and respond differently depending on the keywords present in each message. Bots can even be taught to use machine learning to adapt and improve their responses to situations.

Bots can also be used for various other purposes such as communicating with website visitors, conducting research, qualifying your leads, and personalizing the user experience and they can even be integrated with messaging platforms to increase engagement by starting a conversation.

All these are just a few of the various functions that you can achieve with bots. Still reluctant to try them out? Probably not as much as before. Now let’s dive into detail and see why bots are incredible and how they can benefit those in the insurance industry specifically.

Use cases of bots in the insurance industry

When it comes to the insurance industry, there are a number of factors to be considered. The insurance industry is built on making customers feel safe and reassured. This is due to the fact that insurance is supposed to cover worst-case scenarios that most people don’t want to ever consider or think about. However, making customers think about the worst-case scenario is often necessary if you want them to consider insuring themselves against it.

This means that any application you use bots for needs to help reassure customers more than traditional human interaction would.

Fortunately, with the right steps, this isn’t very hard to do.

1. Enhance your customer support

Customer support today is expected to be 24/7 round the clock. Customers are no longer willing to wait multiple days to hear back from support executives. In fact, in most cases, customers want to be able to fix issues themselves whenever possible, quickly and without much of a delay.

Any delays or hitches in the availability of customer support can cause customers to immediately reconsider your services and this is not something you want to happen.

Using bots for insurance marketing allows you to provide a level of accessibility and availability to your customers that isn’t otherwise possible. You can create a self-service kiosk and integrate a chatbot to answer commonly asked questions and provide help so that customers can fix the issues themselves.

Not only does this massively decrease wait times but it also allows you to manage with fewer support agents. This reduced operational cost can be huge in savings for your business and on the customer’s side, they have the added benefit of being able to find help at any hour of the day.

The bot can also be trained to deploy resources from the knowledge base to help customers to better help themselves. All these factors come together to help give you rock-solid customer support which means that your customers will be taken care of better than they could be with a human team.

2. Manage your internal operations

As companies grow and scale it becomes necessary to implement systems and streamline internal operations. Often, a problematic situation can arise when multiple systems are set in place and there is no clearly defined procedure. This can lead to hold-ups and backlogs with respect to work pending.

As the size of your organization gets bigger, the more the effects of temporary holdups with work are felt, and the harder it becomes to properly manage the internal operations of your business.

Fortunately, bots use AI and so they can be easily programmed to handle complex systems that might already be in place. This means you can use them to streamline processes and create a more efficient system that is less subject to errors.

Some great applications for bots to manage include streamlining tracking of employee expenditure, employee leave, internal communication, and any processes that require inter-department communication where they may not be an already existing system in place yet.

3. Grow multi-channel touchpoints

In addition to different marketing channels having different strengths that can be used as part of the marketing strategy, customers may also have preferences over which channels they use to reach out for support.

There are several benefits of having multi-channel touchpoints. Using multiple channels as a brand allows your customers to have better access to you but also gives you the benefit of expanded reach. Several of your customers use only a few channels or are active on just one or two channels and by ensuring that your campaigns are across multiple channels you can expand your reach considerably.

There’s also the added advantage of increased engagement and the fact that it’s more effective in terms of customer support to be able to be contacted across multiple channels. However, this also means that it can get difficult to collect and sort support tickets when they come from multiple sources.

This is another brilliant application for bots to shine. You can deploy a single insurance bot across multiple channels in order to reach out to customers irrespective of where they are, centralize data collection from customers across multiple channels, streamline the customer support experience so that customers don’t feel hassled or forced to switch channels to have their tickets resolved, etc.

This can also help grow clientele through cross-promotion of your policies to monoline accounts.

A monoline account is a customer that has only one product – say a home insurance policy.

The insurance industry is highly competitive. It’s difficult to acquire new customers and it can be expensive to acquire them through advertising. The goal is to build relationships with your policyholders so that when the time for their additional insurance coverage comes up, they will contact you first.

Office Bot and Marketing Bot make this easy because it automates sending emails to customers.

Your bot will enable you to be proactive, reach out, and expand the relationship with your customers. It can use multi-channel campaigns to increase your average premium per account.

4. Faster claim processing and payments

Manually managing payments and processing claims can be an absolute nightmare. As the size of your insurance agency grows this only gets worse and ultimately errors will begin to creep in no matter how organized you try and keep things.

Fortunately, bots can also be programmed to address new customer claims about insurance as well as follow up on existing ones that are ongoing. It’s also much easier to organize and keep records when everything is programmed and automated according to fixed conditions.

For example, one such essential touchpoint is during the onboarding process. When a new policyholder joins your insurance agency, the agency can quickly communicate with that client using marketing automation. This welcome campaign could include a series of emails and texts that provide:

- Information about the coverage and their policy

- Important filing dates

- How to contact their agent for further assistance

When it comes to closing claims, insurance marketing bots can also be used to streamline the process in a meaningful way. The bot can be used to create claims series and send a message when a claim is open and a survey when it’s closed. A message can also be sent when there are additional questions or concerns about the claim.

When a customer replies, the agent will see their response within the software interface, eliminating unnecessary emails and phone calls.

By communicating with clients through bots, agencies can increase client loyalty and ensure that new clients are prepared for their first policy renewal.

Using bots for this purpose also means that you’ll never have to worry about keeping track of customer payments, or how many days have passed since a claim that has been raised is properly addressed and the bots will handle this, as well as send reminders whenever necessary making life much simpler for everyone.

5. Improved lead profiling and conversions

Lead profiling involves asking questions to better understand and convert leads into buying customers as they progress down the sales funnel. Typically, lead profiling can involve requesting a lot of information which is known for turning customers away.

Customers, in general, don’t like being asked to fill out forms and give away personal details especially before being able to make a purchase. This can be a huge turnoff and even lead to purchases being abandoned halfway because customers don’t want to fill out annoying questionnaires.

With progressive profiling, you make sure to ask only the most important questions necessary at the stage that the lead is currently at. This ensures that you have the necessary information to nudge the lead toward the right direction of the funnel without simultaneously scaring them off by asking too many questions.

When selling insurance, there’s a huge difference between someone who has never heard of you and someone who knows your company and has filled out an application. The latter is much more likely to become a policyholder. This is where marketing bots come in.

You can use a marketing bot to create prospect series in your email marketing and engagement campaigns. Once a lead has been passed to a sales rep, they can enter their contact information into the system. The bot can be programmed to initiate a series of conversations and recommend the next steps to the prospect.

Prospects want to know what’s in it for them and how the insurance agency will help them resolve their issues. By creating an automated email sequence or engagement campaign ahead of time, you can better direct the prospect through the conversion journey of becoming policyholders.

This ability of marketing bots means that you can use automation to ensure that leads get asked for information (and provided information also) only at certain important stages of their buyer’s journey automatically.

Bots also make sure that duplicated information isn’t collected and can keep track of what’s already been asked and stored in the database. This means you don’t have to worry about any of the previous problems and can focus on analyzing the data collected instead which is a much better use of your time as an insurance agency owner.

6. Integrated database management

If you’re not from a tech background, managing a database may seem tricky. However, with bots, you have the added advantage of seamless integration which means that any internal systems you have can work seamlessly in tandem with your marketing bots.

The bots can be integrated with any CRM or database you have already set up so you don’t need to worry about the hassle of overhauling any of your systems to start taking advantage of the benefits offered by a marketing bot.

Bot integrations also include several tools and applications that are often used by other insurance agencies or similar industries and as such have become standard integrations that most bot software will consider and implement while designing their products.

For example, you can automate follow-ups with happy policyholders by integrating your database with your email marketing through the bot.

This creates an opportunity for insurance agencies to grow positive customer testimonials by asking for Google reviews from happy policyholders once a policy period is completed.

The moment a policy is renewed with an agency, that could be the perfect time to request a review from the client since their experience with the agency has been positive enough to renew their policy.

This strategy helps address two of the biggest challenges facing insurance agencies: how to drive more organic traffic to their agency websites and how to get more new business via referrals.

Similarly, you can also win back old clients. By keeping track of clients who didn’t renew their policies or ones that may have lost interest during some point of the conversion funnel in a separate database, you can use the marketing bot to target this list and create re-engagement campaigns.

The software works by sending re-engagement emails and texts to older clients who may have not renewed their policies. This is done by setting up a campaign and setting the desired outcomes. Once the campaign has been set up, the marketing bot can run itself and stay in touch with the prospects.

After all, it is much easier to convert old policyholders you proved your services to than it is to attract new clients.

7. Automating quote follow-up series

Insurance brokers often spend days, weeks, or maybe even months trying to close a lead. The time spent on these leads is extremely valuable, and in some cases, often gets no return on investment.

The good news? It doesn’t have to be this way.

By automating the follow-up process for quotes that are in progress, insurance agencies and brokerages can free up their time to focus on the processes that truly matter.

When a customer requests a quote for an insurance policy, the broker has about a 60-70% chance of closing that customer. But what about the other 30-40%? That’s where the power of automated messages through marketing bots comes into play.

Brokers may think they’ve exhausted all options when they fail to close a quote, but they’re wrong. The truth is that half of those customers will choose to purchase insurance if they get a simple follow-up message.

And when you automate your follow-ups using a marketing bot, you can rest easy knowing that you’ll never miss out on a potential sale again.

Use Pathway’s Marketing and Office bots today!

If you’ve read this far, you now have a crystal clear understanding of the benefits that come with automation and how bots are a great way to give yourself that edge that’s so hard to find in the insurance industry.

While there are several bots out there to choose from, two incredible bots are the Pathway Office Bot and the Pathway Marketing Bot.

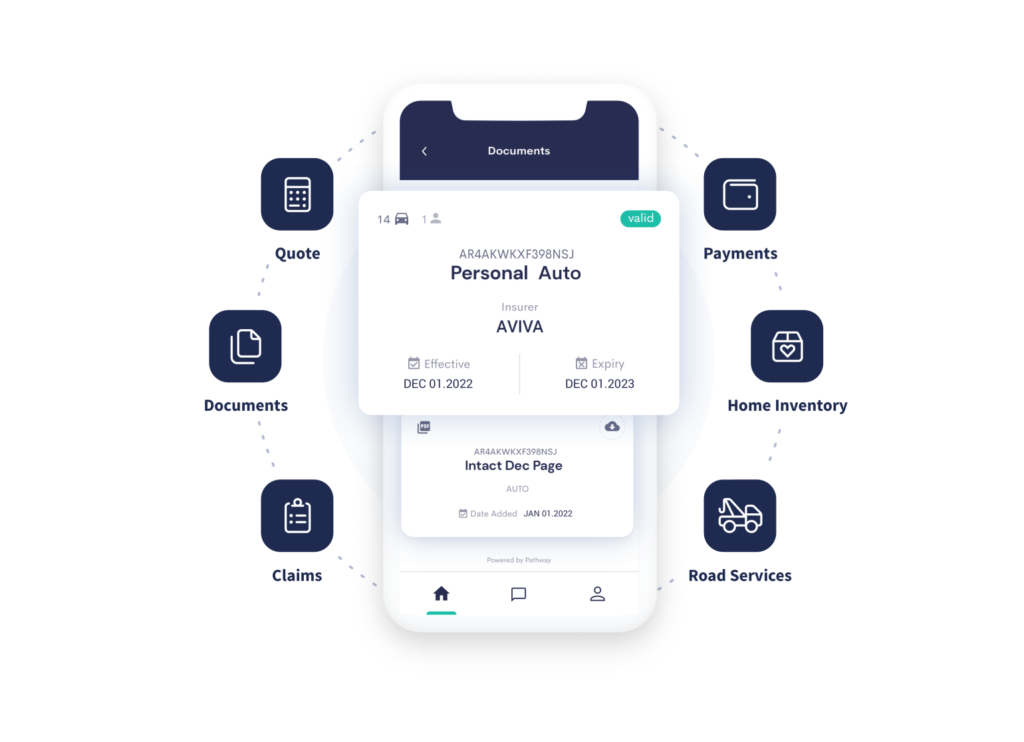

The Office Bot is specially designed for workflow automation, intelligent document delivery, and task prioritization.

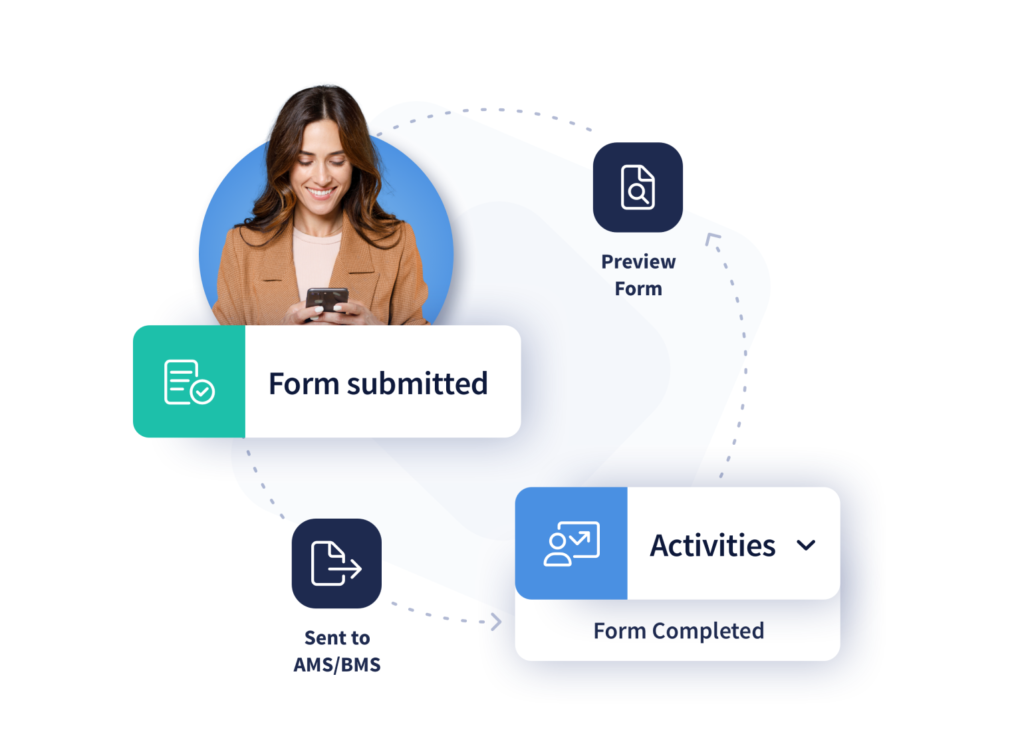

The Marketing Bot is best suited for nurturing relationships and onboarding new clients, increasing revenue and cross-selling to your clients as well as giving powerful data-driven insights as feedback on how the campaign is going.

Together they’re more than enough for your business to succeed.

Leave a Comment